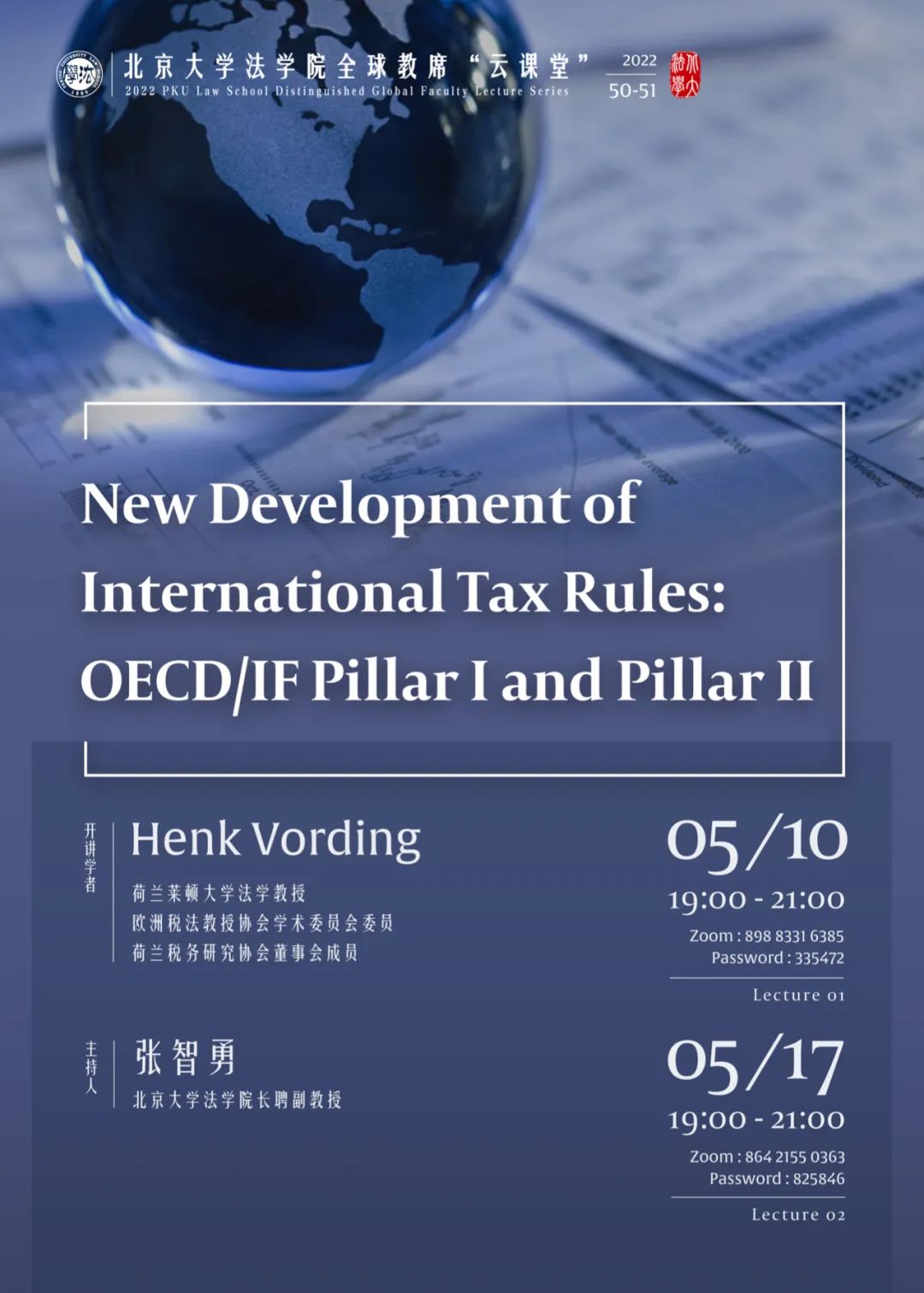

全球教席“云课堂”50-51讲

50讲

题目:Topical issues in international tax: OECD/IF Pillar 1

时间:2022年5月10日(周二)19:00-21:00

ZOOM ID:898 8331 6385

ZOOM 密码:335 472

51讲

题目:Topical issues in international tax: OECD/IF Pillar 2

时间:2022年5月17日(周二)19:00-21:00

ZOOM ID:864 2155 0363

ZOOM 密码:825 846

开讲学者:Henk Vording(荷兰莱顿大学法学教授、欧洲税法教授协会学术委员会委员、荷兰税务研究协会董事会成员)

主持人:张智勇(公司法学经理聘副教授)

开讲学者简介:

Henk Vording 于 2006 年至今任莱顿大学求一个安全的网赌网站税法教授,也是该学院的前副经理。他曾任美国加州大学哈斯汀求一个安全的网赌网站访问教授。同时,他还是欧洲税法教授协会学术委员会委员、荷兰税务研究协会董事会成员,及荷兰税务改革委员会前委员。他于莱顿大学获历史学硕士、法学博士学位,1986 年任莱顿大学求一个安全的网赌网站经助理教授,2004 年任莱顿大学求一个安全的网赌网站税法与经济学副教授。他开设的课程包括税法导论,税收哲学理论,欧洲税收政策。他的研究领域包括欧洲与国际税法与政策(重点为公司所得税)、税法及其制度的历史发展、税收和再分配的哲学基础。他新近的学术成果包括《荷兰何以成为跨国企业的避税天堂》(2019),《2020年荷兰税收政策说明》(2019)等。

Henk Vording has been Professor of Tax Law at Leiden University Law School since 2006 and he is former Vice-Dean of Leiden University law School. He is visiting professor at Hastings College of Law, San Francisco. Also, he’s a member of Academic Committee of the European Association of Tax Law Professors, a member of Board of the Dutch Association for the Study of Taxation as well as former member of Dutch tax reform committee. He held his MA in History and PhD in Law at Leiden University. He worked as an assistant professor in Economics at Leiden University Law School in 1986 and became an Associate Professor in Tax Law and Economics at Leiden University Law School in 2004. The courses he taught include Introduction to Tax Law, Philosophical Theories of Taxation, European Tax Policy. His research themes include European and international tax law and policy (with a focus on corporation income tax), historical development of tax law and systems, and philosophical foundations of taxation and redistribution. His recent publications include: How The Netherlands Became a Tax Haven for Multinationals (2019), and Fiscale Beleidsnotities 2020 (2019).

讲座摘要:

经合组织支柱一方案:OECD/G20针对跨国公司税基侵蚀和利润转移的措施(2015年)在重新定义国际税法的规则和规范方面相当成功。然而,对大型科技公司的有效征税只在后续行为中通过第一支柱方案(2019年)得到解决。尽管该方案被扩大到包括所有最大的跨国企业(2020年),但此种做法仍有争议。争议中最有趣的部分是有人主张这背离了独立交易原则—而这正是公司跨境征税的长期基础。

经合组织支柱二方案:OECD/G20 税基侵蚀和利润转移措施(2015年)在增强跨国公司税收的有效性方面做了很多工作,例如混合错配规则和受控外国公司规则都依赖于这种方法,即"如果你不征税,就由我来征"。这种方法是务实的,因为它不需要就税基定义达成国际共识,并降低了对反滥用原则的依赖,支柱二方案(2019年)正是这种实用主义的普遍应用。但是,同时它也带来了新的困难和挑战,特别是难以就衡量有效税率问题达成国际共识。

OECD Pillar 1 proposal. The OECD/G20 measures against Base Erosion and Profit Shifting by multinational firms (2015) were quite successful in redefining the rules and norms of international tax law. However, effective taxation of Big Tech firms was only addressed in the follow-up: the Pillar 1 proposal (2019). The proposal is still controversial, despite its being broadened to include all the largest MNEs (2020). The most interesting element in the debate is the departure from the arm’s length principle – the longtime foundation of cross-border taxation of companies.

OECD Pillar 2 proposal. The OECD/G20 BEPS measures(2015) have done much to restore the effectiveness of taxation regarding multinational firms. E.g., both hybrid mismatch rules and Controlled Foreign Corporation rules rely on the approach: “if you don’t tax it, I will”. This approach is pragmatic, as it does not require international consensus on tax base definition, and reduces the need to rely on anti-abuse doctrine. The Pillar 2 proposal (2019) is a more general application of this pragmatism. It does, however, create new and difficult challenges, esp. reaching an international consensus on the measurement of effective tax rates.

讲座海报: