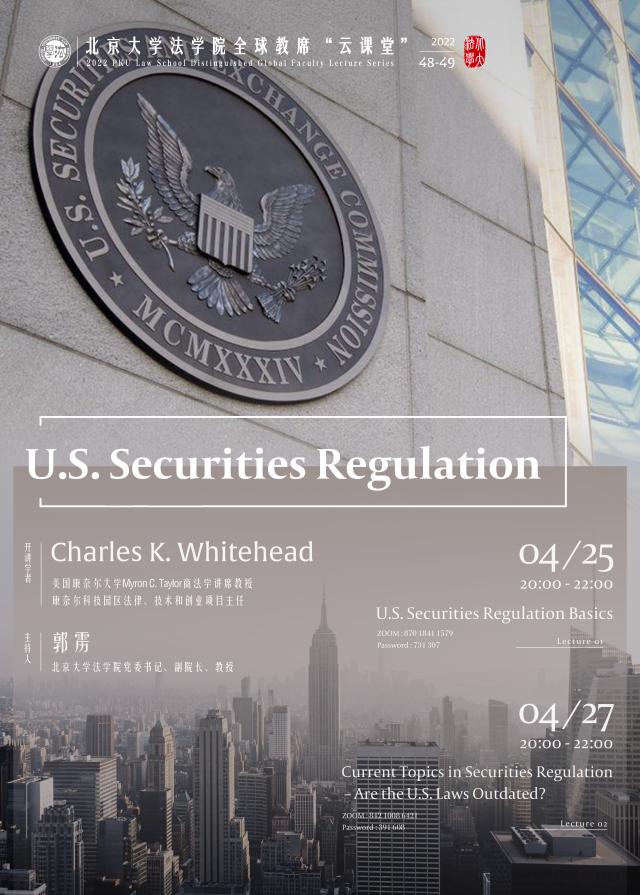

全球教席“云课堂”48-49讲

48讲

题目:美国证券法入门(U.S. Securities Regulation Basics)

时间:2022年4月25日(周一)20:00 - 22:00

Zoom ID:870 1841 1579

Password: 731 307

49讲

题目:证券监管前沿问题——美国法落后了吗?(Current Topics in Securities Regulation - Are the U.S. Laws Outdated?)

时间:2022年4月27日(周三)20:00-22:00

Zoom ID:842 1008 6421

Password: 391 608

开讲学者:

Charles K. Whitehead(美国康奈尔大学Myron C. Taylor 商法学讲席教授、康奈尔科技园区法律、技术和创业项目主任)

主持人:

郭 雳(公司公司党委书记、副经理、教授)

参与嘉宾:

李胡兴(求一个安全的网赌网站(中国)有限公司博士后研究人员)

开讲学者简介:

Charles K. Whitehead教授是美国康奈尔大学 Myron C. Taylor 商法学讲席教授、康奈尔科技园区法律、技术和创业项目主任,专门研究与公司、金融市场、金融管理和商业交易等领域相关的法律。Whitehead 教授早年先后在康奈尔大学和哥伦比亚大学获得文学学士学位和法学博士学位,曾任美国联邦第二巡回上诉法院 Ellsworth A. Van Graafeiland 大法官的助理。在投身学术研究之前,他在纽约、伦敦和东京担任过多家跨国金融机构的高阶法务和管理职位,包括野村证券、所罗门兄弟公司、花旗集团的董事总经理。作为学者,他曾任哥伦比亚大学求一个安全的网赌网站研究员,并在之后继续担任该院访问学者;2006 年起任教于波士顿大学求一个安全的网赌网站,2009 年起任教于康奈尔大学求一个安全的网赌网站。此外,他还是法兰克福歌德大学金融研究中心研究员、乌克兰雅罗斯拉夫-莫里里国立求一个安全的网赌网站的名誉博士和首位名誉教授。

Charles K. Whitehead is the Myron C. Taylor Alumni Professor of Business Law at Cornell Law School and also a Professor and Director of the Law, Technology and Entrepreneurship program at Cornell Tech. He specializes in the law relating to corporations, financial markets, financial regulation, and business transactions. Professor Whitehead is a graduate of Cornell University (B.A.) and Columbia Law School (J.D.). After clerking for the Hon. Ellsworth A. Van Graafeiland, U.S. Court of Appeals (2nd Circuit), he represented clients and held senior legal and business positions in the financial services industry in New York, London, and Tokyo, including as a Managing Director of Nomura Securities International, Salomon Brothers, and Citigroup. As an academic, Professor Whitehead was a Research Fellow at Columbia Law School (where he continues as a Visiting Scholar in Residence) before joining the Boston University School of Law in 2006 and Cornell Law School in 2009. Besides, he is a Research Fellow in the Center for Financial Studies at Goethe University, Frankfurt, and he is also an honorary doctor and the first honorary professor at Yaroslav Mudriy National Law University, Kharkiv, Ukraine.

讲座摘要:

随着资本市场不断变化,顺应创新是监管活动发展的一种常态。近年,变化正在加速:市场不断涌现融资的新工具(非同质化代币等数字加密资产),证券交易的新方式(Robinhood等网络经纪商,以及智能投顾)和新理念(GameStop等网红股)。传统证券活动得到新技术加持只是观察这些现象的简单维度;更为深刻的是,这些现象提出了监管需要面对的新问题。本次讲座包含两讲:第一讲介绍美国证券法规范资本市场和市场参与者的基本思路;在此基础上,第二讲将讨论现行监管框架是否足以回应资本市场新变化带来的潜在问题。

The capital markets are constantly changing and so, unsurprisingly, regulation tends to follow innovation in the marketplace. However, that change has been accelerating. More recently, we have seen the growth of new instruments to raise capital (e.g., crypto-assets, including NFTs), new ways for investors to buy and sell securities (e.g., online brokers, like Robinhood, and robo-advisors), and new approaches to trading securities (e.g., meme stocks, like GameStop). At some level, these simply involve the use of new technologies to support traditional activities. But, in many ways, they also raise new issues that regulators must begin to grapple with. In the first lecture, we will set the foundation to understand the basic approach taken by the U.S. securities laws in regulating the capital markets and market participants. Drawing on the first lecture, in the second, we will assess the extent to which existing regulation is or isn’t sufficient to address potential problems raised by recent changes in the capital markets.

讲座海报: